Forces of Nature.

There’s little question in spite of a steadied 2011 real estate market after two to three years of precipitous decline and recession, Vermonters will remember the extensive damage to real estate and infrastructure brought by Hurricane Irene on the last Sunday in August more than 2011 as the year of market stabilization.

From homes and buildings swept off their foundations and lost completely to entire first floors of homes left deep in silt, it was a massive event materially, in the psyche of the Green Mountain residents, and dominating government action in the fourth quarter. A sudden increase in rental demand, historic property losses and titanic insurance claims leading to the the near-collapse of the federal government’s National Flood Insurance Program (NFIP) ensued.

By some estimates the damage amounts to some three quarters of a billion dollars. The last Vermont highway Vermonters, including those in the Mad River Valley, united to raise historic amounts of money to support those affected. 2011 will go down as the year of Irene for watershed Vermonters.

Japan’s massive north east coast earthquake & tsunami sent reverberations across the globe. From the nuclear meltdown at numerous Fukushima Tepco reactors, ensuing evacuation zones, an estimated 25,000 tsumami related deaths to improved US auto sales following supply interruptions for Japanese automakers, it was an unforgettable year following 2010’s Deepwater Horizon oil spill in the Gulf of Mexico.

With disaster in the rear view mirror, many also view 2011 nationally as the worst year on record (nationally) for new home sales, single family permits, and single family home starts, at least since 1945.

Maple Sweet Real Estate saw, in contrast, our best year in gross sales, tapping into Vermont’s petit economy’s insulation from the broader national woes. and capitalizing on budding demand based on stunningly low mortgage rates and improving employment. Governor Peter Shumlin, in his state of the state address January 5th, outlined Vermont has among the lowest unemployment rate in the nation at just 5.3%. Buyers in Vermont made offers with less trepidation than in 2010.

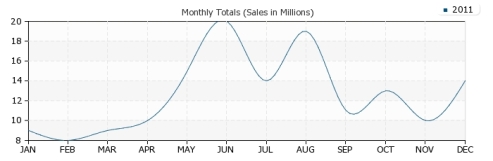

Taking a look at 2011 residential sales statewide, measured in millions:

2011 Vermont mls residential (excluding condominiums) sales numbered 4,012 units vs 3,986 in 2010, a slight uptick. Of these:

Stowe, 69 improved over 57 in 2010, Mad River Valley 54 vs 51, Chittenden County 875 vs 856, Montpelier 45 vs 42, and in Addison County 228 vs 192. While the improvements are modest, these sales reflect the beginning of a gradual recovery.

Among Highest 2011 Central & Northern Vermont Residential Sales:

Addison County $1,650,000 630 Mile Point Rd, Ferrisburgh, half an acre

Chittenden County $1,780,000 3611 Harbor Rd, Shelburne, 1.4 acres

Mad River Valley $1,275,000 1497 Bragg Hill Rd, 21 acres

Montpelier, $415,000 65 College St, just over half an acre

Stowe $4,000,000, 551 Edson Hill Road, 44 acres

“In the most recent report, the Census Bureau reported that the new-home market continued its rebound, with sales of new houses once again inching up last month. New-home sales rose 1.6 percent from October to November to an annualized rate of 315,000, and sales were up nearly 10 percent compared to November 2010.

The median sales price of a new home in November was $214,100, the Census Bureau reported, and the inventory of new houses nationwide decreased to a six-month supply at the current sales pace.” -National Association of Realtors (NAR), RealtorMag 12.27.2011

And from NAR’s REALTOR.org: “Pending home sales continued to gain in November and reached the highest level in 19 months”. The Pending Home Sales Index,* a forward-looking indicator based on contract signings, increased 7.3 percent to 100.1 in November from an upwardly revised 93.3 in October and is 5.9 percent above November 2010 when it stood at 94.5. The October upward revision resulted in a 10.4 percent monthly gain. The last time the index was higher was in April 2010 when it reached 111.5 as buyers rushed to beat the deadline for the home buyer tax credit. Lawrence Yun, NAR chief economist, said the gains may result partially from delayed transactions.

“Housing affordability conditions are at a record high and there is a pent-up demand from buyers who’ve been on the sidelines, but contract failures have been running unusually high. Some of the increase in pending home sales appears to be from buyers recommitting after an initial contract ran into problems, often with the mortgage,” he said.

“November is doing reasonably well in comparison with the past year. The sustained rise in contract activity suggests that closed existing-home sales, which are the important final economic impact figures, should continue to improve in the months ahead,” Yun added.”

Morgan Stanley coined 2011 the “Year of the Landlord”. Rental property demand surged in line with tight money and tightened lending conditions in spite of historically low interest rates. Multi-family homes, a perennial investor favorite, have been an even more attractive investment given the difficulties of obtaining mortgages and the attraction of renting out one or more of the purchased units as a hedge against carrying costs.

According to Reuters, starts for structures with five or more units increased nearly double year-over-year levels along with a 2.6% rental cost increase compared with just six tenths of a percent in 2010.

Standard & Poor’s downgraded American’s AAA debt rating in August to AA+. The Euro faced it’s biggest challenges yet with the dismal state of the 17 nation eurozone, putting some Vermont buyers on alert following rescues of both the Greek & Irish economies, strained situations in Italy, France & Spain, and tumbling stocks. Many view it as the most serious european crisis since World War II.An historic run of low interest rates.

2011 S&P 500 from http://www.seekingalpha.com

The S&P 500 ended nearly where it started with major dips due to the Japanese earthquake and tsunami and the resulting Fukushima Nuclear Crisis and the Budget debacle & US credit downgrade.

An unprecedented run of historcially low 30 year mortgage rates starting and ending in the four and three quarter per cent range, 2011 may go down in history as the year to have borrowed, not to mention the smiling faces of mortgage brokers all over the state as the refi (refinancing) apps came pouring in. The brilliantly low interest rates are expected to continue early into 2012, remaining between four and five per cent for much of the new year.

Mike Donnelly of the Washington Post in a December 25th article: Distressed commercial real estate in the United States — including properties in default, foreclosure or taken back by lenders — totaled $171.6 billion in October 2011. That is a dip from the recent past.

Also expected in 2012 is a continuance of the gap between home seller and buyer expectations, according to the Mortgage Bankers Association in this HousingWire article. With many sellers anchored to past value perceptions and buyers operating in still recessionary markets, a higher than usual per centage of offer and counter offer negotiations have fallen through than under more usual circumstances.

“Bottom line, whether due to even lower prices, historically low mortgage rates, falling inventory and a better labor market or a combination of all, the housing market is showing signs of stabilizing” according t0 Peter Boockvar at Miller Tabak.

Maple Sweet Real Estate welcomes outstanding sales associate Jennifer Stella, who moved to Vermont from Bermuda.

Maple Sweet Real Estate welcomes outstanding sales associate Jennifer Stella, who moved to Vermont from Bermuda.

Maple Sweet advertising expands with a new Maple Sweet Vermont Public Radio ad campaign airing thrice weekly throughout 2012. Building on the record successes of 2011, and based on the state and national trends outlined above, we expect 2012 to continue to improve in terms of local and statewide sales.

Connect to maplesweet.com, e-mail info@maplesweet.com or call toll-free 1-800-525-7965 to list your property, arrange for showings, or look further into Vermont’s real estate market.

Leave a comment