Three straight months of S&P/Case-Shiller home price index increases and improving existing and new home construction and sales are leading to less cautious optimism about the burgeoning rebound.

This week Maple Sweet Real Estate clients became frustrated with an out of state lender and requested an alternative. With a closing just three weeks away, we scrambled. A top shelf Vermont mortgage provider didn’t think it could happen and apologized only because all of their appraisers were flat out, at least three or four weeks away from even getting into a new job to start the work, adding projected extra time to the contract to closing period. I made some calls and was able to find a single appraiser that could ratchet things up and now we’re back on track to close on time. The close call and appraisal traffic jam are blessings in disguise as they signal significantly higher than usual volume of new mortgage and refinancing applications.

This week Maple Sweet Real Estate clients became frustrated with an out of state lender and requested an alternative. With a closing just three weeks away, we scrambled. A top shelf Vermont mortgage provider didn’t think it could happen and apologized only because all of their appraisers were flat out, at least three or four weeks away from even getting into a new job to start the work, adding projected extra time to the contract to closing period. I made some calls and was able to find a single appraiser that could ratchet things up and now we’re back on track to close on time. The close call and appraisal traffic jam are blessings in disguise as they signal significantly higher than usual volume of new mortgage and refinancing applications.

Who could have predicted 30 year mortgage rates would drop below 3.5% . Some property owners have refinanced three times in just five or six years.

Maple Sweet Real Estate Q3 sales include a bidding war on this beautifully built William Moore built Moretown cape. Listed at $348,000, it closed at $355,000, both bidding buyers brought to the table by Maple Sweet.

Astute buyers and property owners are increasingly harvesting the spectacular combination of incredulously low mortgage rates and more realistic sellers motivated to move on following longer periods on the market related to pulling out of the recession. Looking back at an era of 12 and 13% interest rates shines an astonishing light on the opportunities for real estate investors, first time buyers, repeating home owners and home flippers. Fueling this record run of historic mortgage rates, the Federal Reserve is purchasing tens of billions in mortgages a month.

The National Association of Realtors outlined sales of previously owned homes rose at the fastest pace in August in more than two years. Joshua Pollard of Goldman Sachs predicted new government mortgage policies, tight previously owned home inventory and other factors could drive new home sales growth up as much as 30% over the next few years.

Commercial vacancy is also improving. According to realtor.org office vacancy rates have dropped from 16.6% in 2011 to 15.7% in 2012, retail vacancy rates from 12.5% to 10.7%, and multi-family vacancy rates from 5.2 to 4.2%.

Luxury Q3 M LS Sales

5 in Chittenden County including 400 Crosswinds, Charlotte, $1,800,000

139 East Shore Road, South Hero, $1,115,000

466 Henry Hough Road, Waterbury, $1,600,000

112 Thomas Pasture Road, Stowe $1,250,000

100 Haul Road, Stowe $1,200,000

Vermont, according to the Department of Labor, continues to hold the lowest unemployment rate in the northeast and the fifth lowest in the nation. Our diverse mix of businesses has helped insulate Vermont against the more dramatic recessionary conditions other states have experienced. Vermont’s population is approaching 630,000:; the only state with fewer people is Wyoming, and Vermont has no major urban areas and under 10,000 square miles.

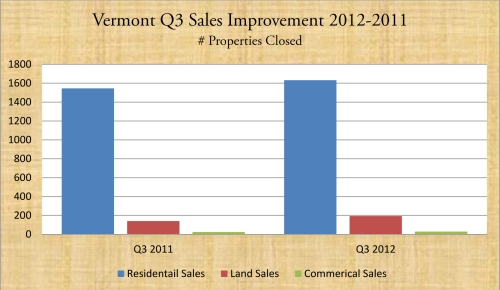

There is little question the market has improved over the last year. Here are the third quarter stats for 2012 vs 2011:

Residential Sales, 1,632 vs 1,545 Land 193 vs 140 Commercial 28 vs 24

Median Q3 residential sale price comparisons, 2012 vs 2011 (as these are for just one quarter, #’s are skewed in some cases by just one strong sale):

Warren $279,000, up from $235,000

Waitsfield $310,000 up from $290,000

Montpelier $245,000 down from $252,250

Stowe $384,500 up from $349,000

Shelburne $337,000 down from $446,000

Burlington $352,750 up from $313,500

With the presidential election just a month away, there is cause to be even more hopeful as some investors are holding back to move forward until after the election given the ambiguity leading up to it. Affordability is hovering at all time highs as this article, “Election 2012: Will it Affect Your Decision to Buy a Home?” highlights from AOL Real Estate, forecasting further Q4 price increases. One consideration is whether Obama’s proposed refinancing expansion (of HARP, or the Home Affordable Refinancing Program) will become law, which could triple the number of homeowners eligible to refinance their mortgage. “We don’t know what the future holds, and we can’t afford to waste a lot of time.” stated Barbara Boxer, California Senator, in this Bloomberg Businessweek article.

Connect to maplesweet.com, e-mail info@maplesweet.com or call toll-free 1-800-525-7965 to list your property, arrange for showings, or look further into Vermont’s real estate market.

Leave a comment